Alabama Cottage Food Law Taxes

Labels may need to be submitted to the local health department for approval prior to selling.

Alabama cottage food law taxes. Of course you should also check with your accountant or tax attorney. A home based food business is allowed to make and sell baked goods cakes breads danish donuts pastries pies and other items prepared by baking the item in the oven. Zoning related issues for home based businesses available in. Restaurants novelty shops grocery stores over the internet specific foods.

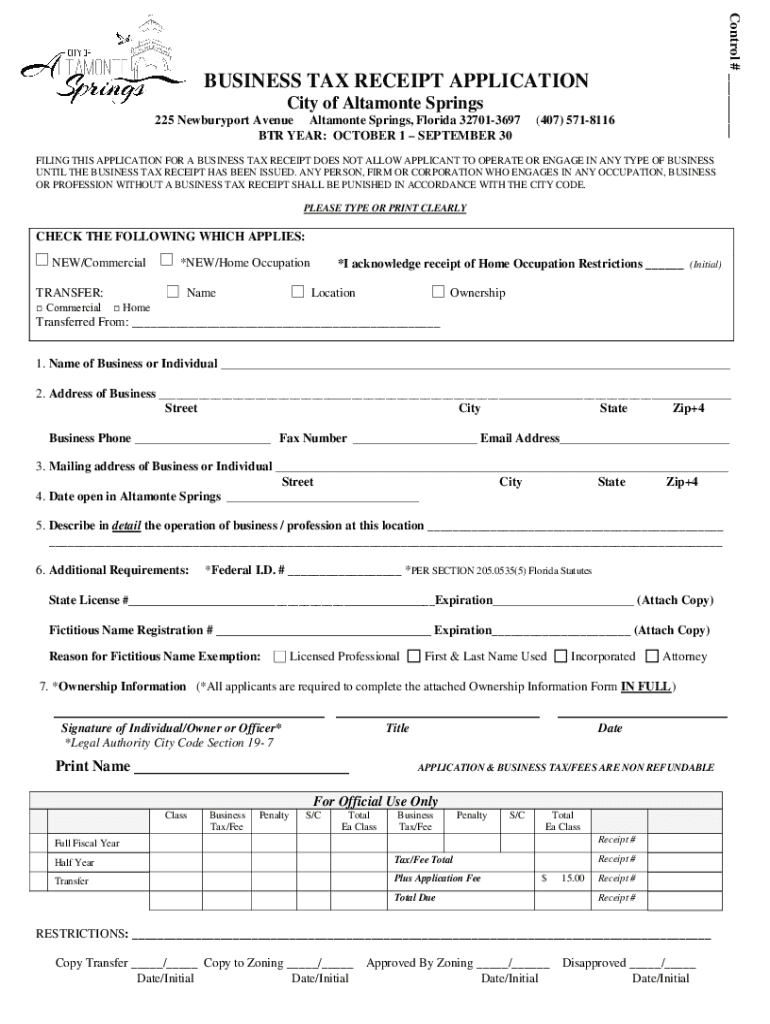

File a review form complete a review form for their cottage food operation with the local county health department. This is a layman s perspective. Alabama cottage food law course the alabama cottage food law went into effect in 2014 and provides guidance and information for cottage food entrepreneurs. Salient points of the rules governing home based food businesses in alabama include.

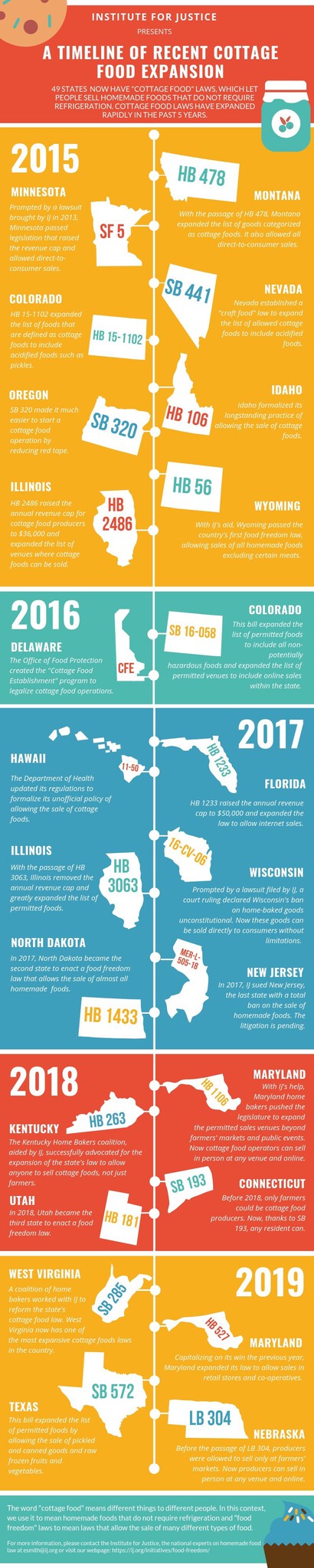

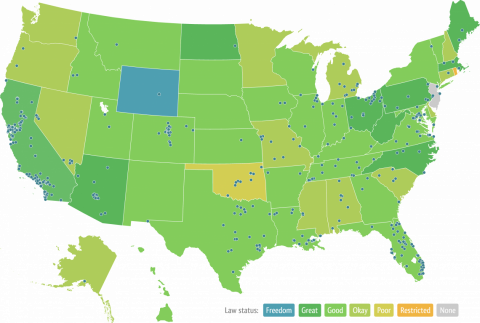

Alabama created a cottage food law sb 159 in 2014. Some states require that the food preparers take and pass a special training course and certification. Cottage food production is governed by alabama s cottage food law sb 159 that went into effect on june 1 2014. You need to find out what.

Annual sales limit you cannot exceed 20 000 in sales of the food described under the alabama cottage food law. According to the state of alabama cottage foods may be sold from home or at local state sanctioned farmer s markets. What can you sell. See this page about collecting reporting and remitting sales taxes on cottage food sales.

The law states t. Sales tax home processed products are subject to sales tax. Does this course include legal information. States don t want home entrepreneurs selling particular foods.

Cottage food operators must take a food safety training course and are limited to 20 000 of sales per year. Many of the states that allow cottage food businesses basically making and selling certain allowed food products from and out of your home have lots of guidance except about taxes. Course materials will reinforce what you learn in the official certification course for the alabama cottage food law certification exam but we will focus on topics and issues not covered in the basic certification course. Collecting taxes on your cottage food sales.

Previously this state only allowed homemade food sales at farmers markets. They ban certain foods that have an involved storage or preparation process. Food sales under the cot tage food law cannot exceed 20 000 per year and are subject to state county and city sales taxes. Politics as usual an exception.

Businesses are also responsible for pay ing state and federal taxes on income earned through food sales. Montgomery and calhoun counties are exempted by state statute from the following requirement. It allows direct in person sales of many non perishable food items. This cottage food law is relatively restrictive.

If your state is not in the list below see this summary of states that do not allow. The cottage food law. Cottage food cannot be sold to the following. Sales taxes the home kitchen food business module 4.

:max_bytes(150000):strip_icc()/blueribbon-f69fc2ef060846bfa616079f4146b94e.jpg)